Today, large and small businesses use cutting-edge AI marketing tools to promote their brands and grow their enterprises through artificial intelligence (AI). With AI marketing tools, automated decisions can be made based on analysed data and interpreted against current market trends. They can predict consumers’ next actions in real time without human involvement, making them incredibly powerful for businesses.

AI-based marketing tools are vital for bloggers, e-commerce entrepreneurs, and affiliate marketers alike. Therefore, you will be able to develop and implement a more effective marketing strategy, which will assist you in meeting your goals more effectively.

To maintain a competitive edge in this rapidly evolving marketplace, staying current on the top AI areas in marketing is essential. This article will explore some of the best tools available for these areas, providing you with valuable information to maximise the potential of AI marketing in your organisation.

AI-Powered Analytics

AI analytics tools are technology-driven solutions designed to collect, analyse, and interpret data related to marketing efforts. Businesses can use them to gain insights into marketing campaigns, customer behaviour, and overall performance. This enables businesses to make data-driven decisions and optimise their marketing strategies.

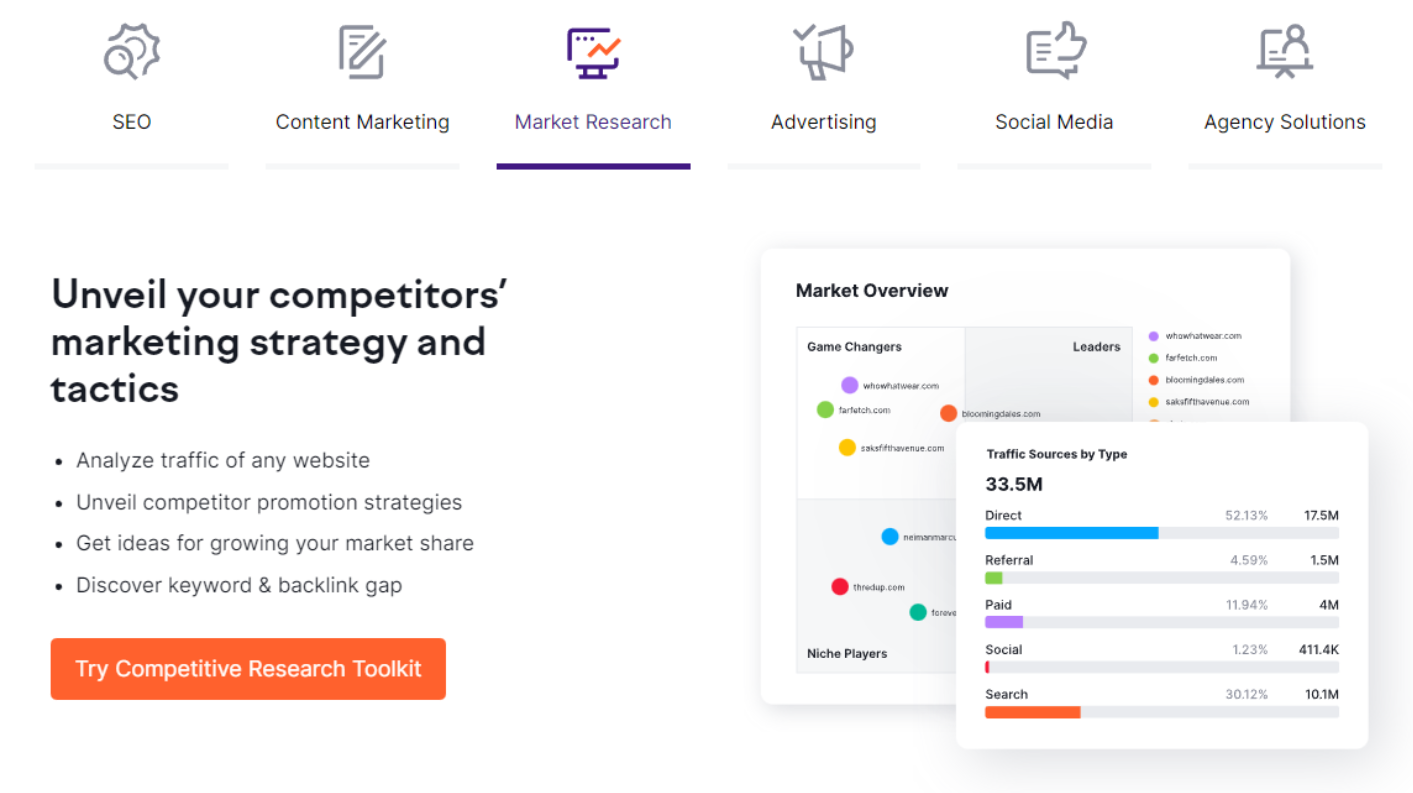

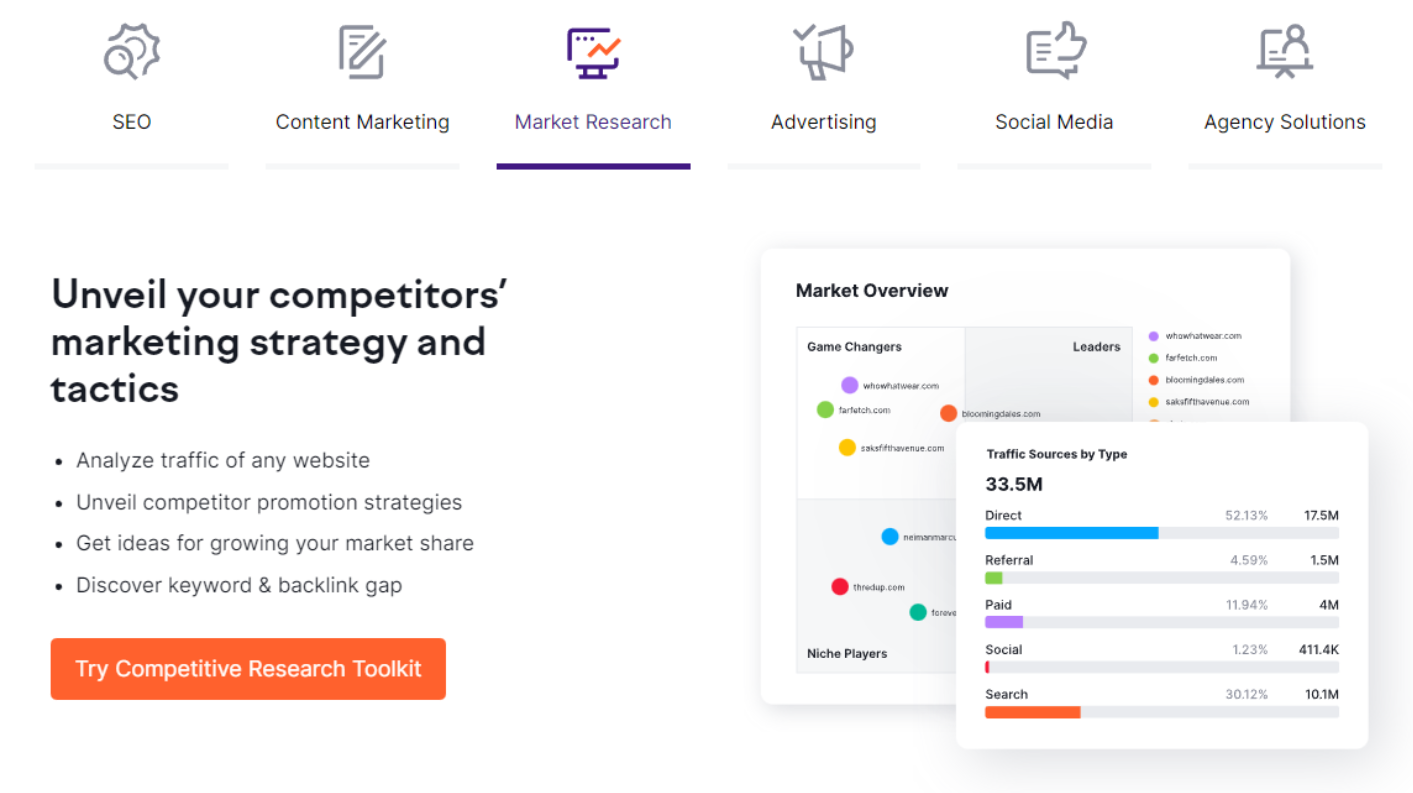

By leveraging these tools, businesses can gain a competitive edge and stay ahead of the curve in an increasingly data-driven world. A good example of such a tool is SEMrush, which is used for AI analytics.

SEMrush

SEMrush is a renowned name in the field of marketing. They offer a range of digital marketing tools that can help businesses optimise their marketing strategies, improve their online presence, and gain insights into their competitors’ strategies. Their platform includes tools for search engine optimization (SEO), pay-per-click (PPC) advertising, content marketing, social media marketing, and competitive analysis.

Moreover, SEMrush provides various AI-powered tools such as the content outline builder, SEO Writing Assistant, and ImpactHero. These tools can assist in improving online presence by identifying gaps in content and providing insights for optimizations. By utilising their suite of tools, businesses can stay ahead of the competition in an ever-evolving digital landscape.

AI Email Marketing

AI email marketing refers to using artificial intelligence-powered tools and technologies to enhance various aspects of email marketing campaigns. AI-based email marketing can optimise email marketing campaigns’ construction, administration, and optimisation to make them more efficient and effective, resulting in stronger connections with audiences and higher conversion rates.

Overall, these tools enable marketers to create more targeted, personalised, and timely communications, resulting in stronger connections with their target audience and higher conversion rates.

Twilio SendGrid

Twilio SendGrid provides a suite of tools for developing effective email marketing campaigns. These include email automation, sign-up forms, email testing, email design, email templates, and email statistics. In addition, they provide an email API with SMYP service, email validation, deliverability insights, dynamic templates, and email integration.

It employs AI in three key areas:

- Validation of email addresses: The real-time API examines your list to detect and prevent invalid email addresses, keeping your list clean and lowering bounce rates.

- Neural protection: This improves your deliverability rates by identifying potentially dangerous transmission patterns. The AI examines outgoing messages to identify ways in which you harm your reputation with ISPs.

- Deliverability insights: The AI analyses your real-time metrics and email performance to provide suggestions for enhancing email deliverability.

AI Graphic Designing

Effective visual representation of campaigns is crucial for lead generation and prospecting in marketing. AI-powered graphic design solutions assist in developing, editing, and optimising visual material. These tools leverage artificial intelligence to automate various aspects of graphic design, making the design process simpler and more efficient for experienced designers and non-experts.

By streamlining and improving the design process, these tools enable the creation of visually alluring and effective graphics that can facilitate better engagement with the target audience and help achieve marketing objectives. DALL is one such AI-powered graphic design tool that we will explore.

DALL-E

Among the most popular tools in creating graphics is DALL-E. The DALL-E AI from OpenAI can create unique pictures based on written descriptions. It is a creative tool that combines natural language processing and image generation, allowing it to generate original visualisations based on user input.

While DALL-E isn’t free ($15 for 115 credits), it’s a great way to quickly and easily create engaging photos for use in social media, email marketing, and advertising. In addition, you may load an existing picture to use as a template.

AI Copywriting

Next up, we have our AI-generated copywriting. Artificial intelligence copywriting solutions use Natural Language Processing and Machine Learning models to streamline the writing, editing, and publishing processes.

These resources make copywriting less time-consuming and more accessible, empowering writers of all skill levels to produce excellent content for use in marketing campaigns, blogs, social media posts, and other contexts. Two of the most popular tools for creating marketing copy are ChatGPT and Jasper. There is no denying that these tools have garnered headlines in the copywriting world. Now let’s dive into each tool in more detail:

ChatGPT

OpenAI created ChatGPT, an AI-powered text generation model that can understand and generate conversational-like text. Here are some of the ways that ChatGPT can help with marketing copywriting:

- Write copy: ChatGPT can be used to write full pieces of marketing copy, including blog posts, website copy, and email marketing campaigns. This saves time and creates high-quality content.

- Edit and refine copy: ChatGPT can also be used to edit and refine marketing copy. This can be helpful for copywriters who want to make sure that their copy is clear, concise, and persuasive.

- Generate ideas: ChatGPT can be used to generate new ideas for marketing copy. Copywriters who are stuck or who are looking for new methods can benefit from this resource.approach a campaign.

- Brainstorm headlines and taglines: ChatGPT can be used to brainstorm headlines and taglines for marketing campaigns. It can be a time-consuming task, but ChatGPT can help to speed up the process and generate more creative ideas.

In general, ChatGPT can improve the marketing copywriting process. By using ChatGPT, copywriters can save time, generate new ideas, and create more effective marketing campaigns.

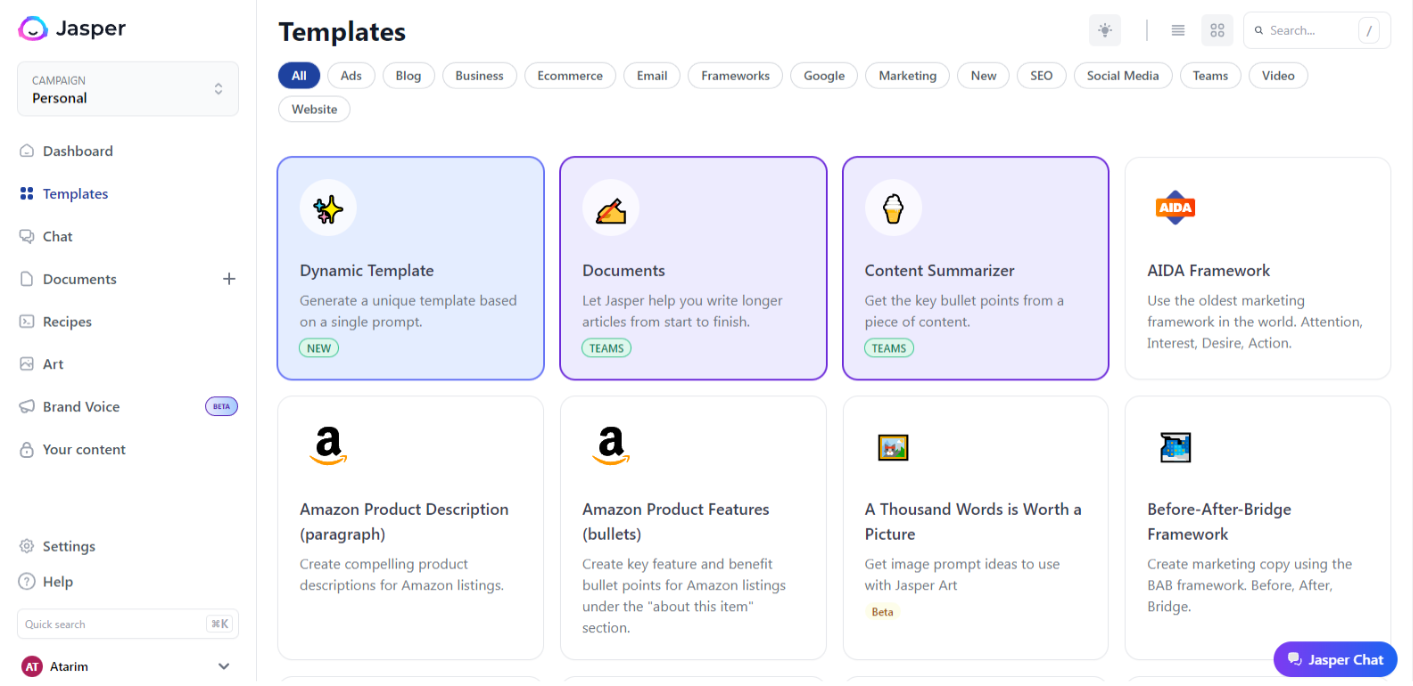

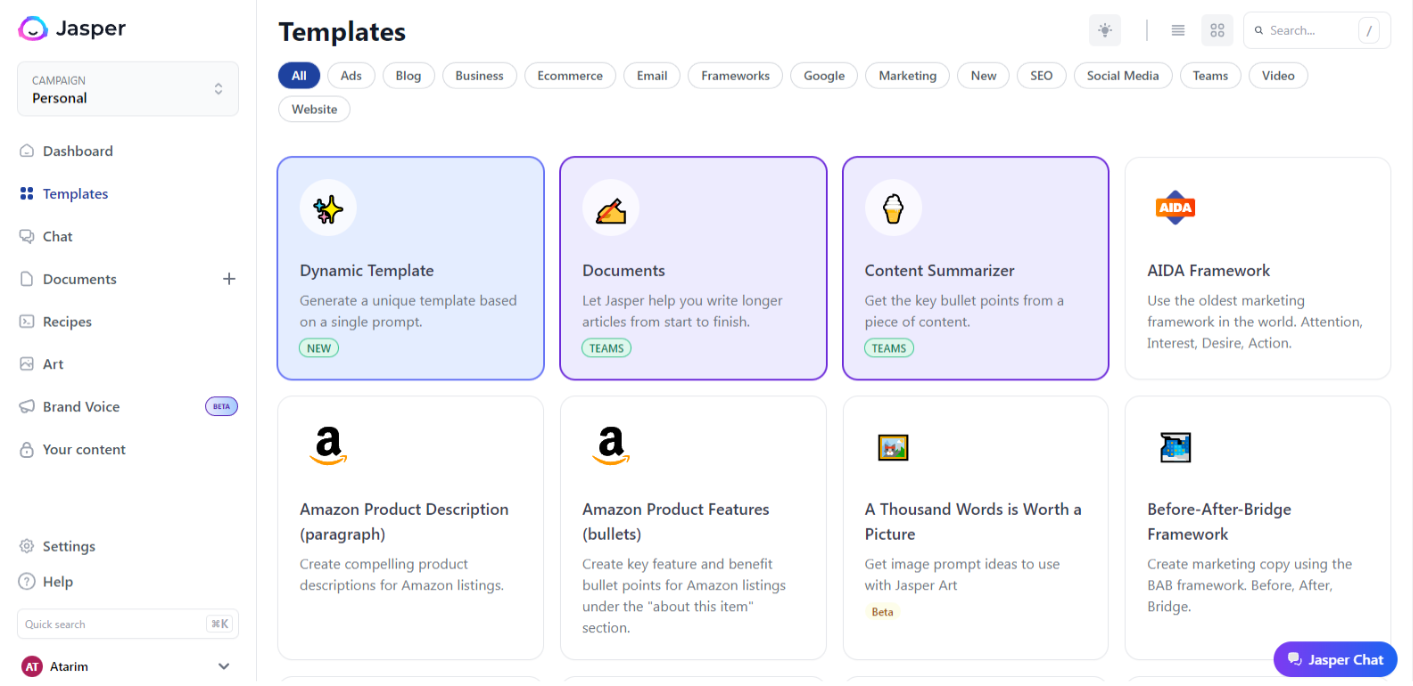

Jasper AI

Jasper AI and ChatGPT are both AI-powered language models, but separate entities develop them and have unique use cases. Conversion.ai has developed Jasper AI, formerly known as Jarvis. It is a copywriting tool designed to assist businesses and individuals in producing high-quality content for a variety of purposes.

Jasper helps in creating marketing copy by using a combination of Natural Language Processing (NLP) and Machine Learning algorithms to analyse and understand the brand’s voice, target audience, and marketing objectives. Jasper AI provides users with content templates and prompts, speeding up the process of content creation and sparing them time. Here’s how Jasper can assist in creating different types of marketing copy:

- Social media posts

- Email marketing campaigns

- Landing pages

- Blog posts

- Case studies

- Press releases

Overall, Jasper helps in creating marketing copy by leveraging its AI-powered capabilities to understand your brand’s voice, audience, and goals.

AI Video & Audio Editing

To assist in the production of audio and video marketing materials, an essential category is the use of AI-powered video and audio editing applications. This collection of applications simplifies the production, modification, and optimization of audio and video content. Through the use of these applications, editing and producing video and audio content becomes more accessible and efficient. This allows professionals and non-experts alike to craft high-quality videos and audio files for various purposes, including marketing materials, podcasts, and social media postings. Finally, these tools prove to be of great use for enhancing the effectiveness and reach of audio and video marketing materials.

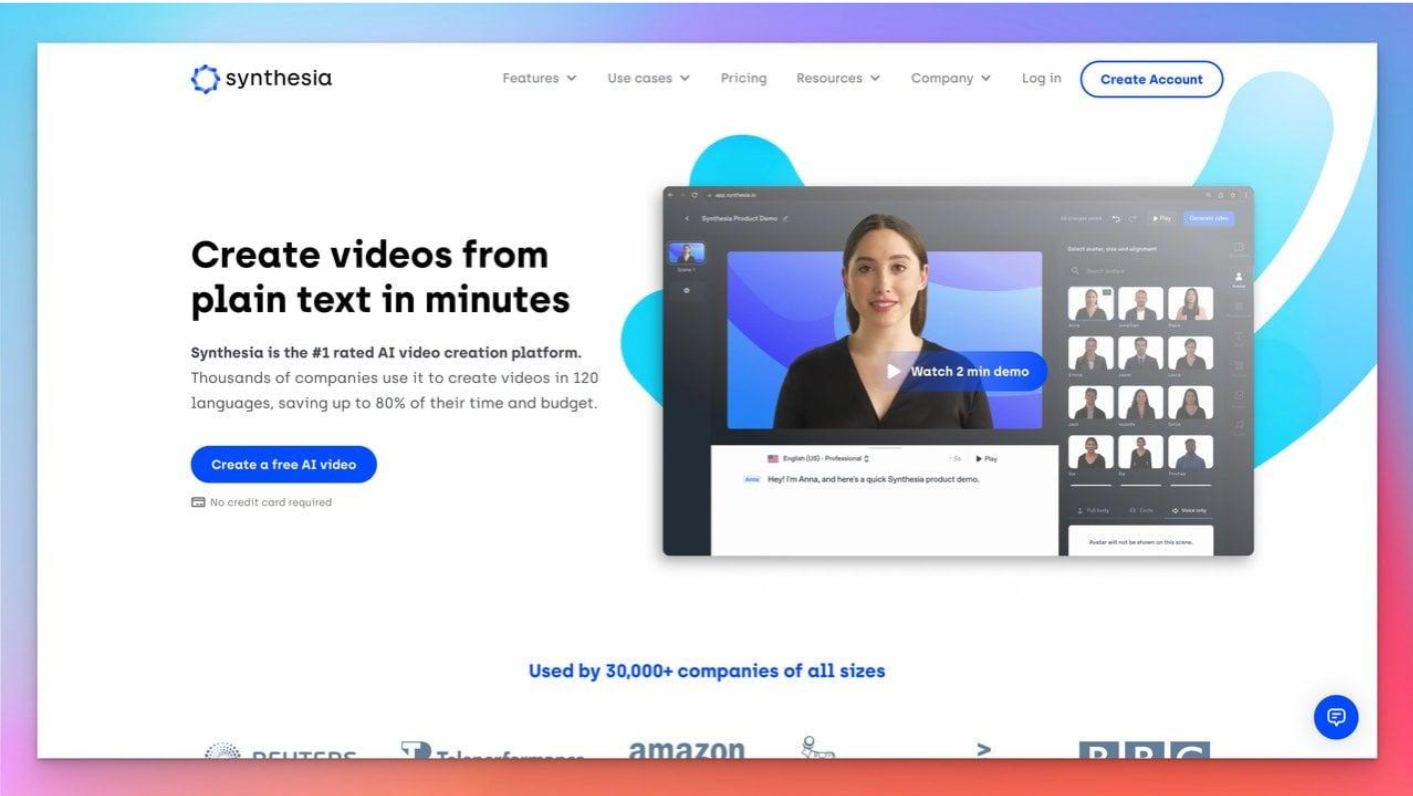

Synthesia

Synthesia is an AI-powered video creation platform that can help you save time and money when creating videos in multiple languages. Over 50 video templates and 70 AI avatars are available in Synthesia, so you never have to repeat the same templates.

You can use Synthesia for your business in the following ways:

- Train your employees with educational content.

- Produce synthetic media in large quantities.

- Replace voiceover actors with it.

- Use it for HR onboarding.

- Enhance your video marketing.

However, using these tools raises security concerns, particularly when dealing with sensitive marketing data. Using a VPN can solve this problem. By using a VPN, marketers can ensure the security and privacy of their data and prevent unauthorised access to it. A VPN encrypts all data being transmitted and creates a secure connection. This means that even if a third party intercepts the data, it will be unreadable. To ensure maximum security, choosing a reputable VPN service suitable for marketers who want to use AI tools securely is important.

Conclusion

Artificial intelligence has vastly transformed the marketing industry, providing businesses of all sizes access to advanced AI marketing tools to enhance their brand and expand their operations. These AI marketing tools leverage AI technology to make automated decisions based on analysed data and current market trends. By utilising AI-powered analytics, email marketing, graphic design, and copywriting tools, businesses can gain actionable insights into their marketing campaigns, strengthen their marketing strategies, and create visually appealing graphics that improve marketing outcomes.

The evolving landscape requires businesses to incorporate AI-powered marketing tools into their strategy to stay ahead of the curve in a data-driven world, make data-driven decisions, and execute a successful marketing strategy. AI-powered marketing tools enable businesses to gain a competitive advantage, enhance their online presence, and improve their conversion rates, leading to a better return on investment.